How much credit score is good?

Who thought a simple number called a credit score will define the creditworthiness of a person trying to seek any form of credit. Well, yes that is how crucial your financial scorecard is for prospective lenders. But before we talk about the extent to which a credit score report is significant for an individual to borrow money hassle-free, first let’s understand what exactly a credit score is. In simple words, it is a three-digit number that ranges between 300 -900 and has the power to decide an individual’s credibility to pay his debts. Institutions like Banks, housing finance companies, NBFC, or any Fintech always check a client’s credit score to assess their profile. Then they decide whether to lend or not to lend money to the borrower.

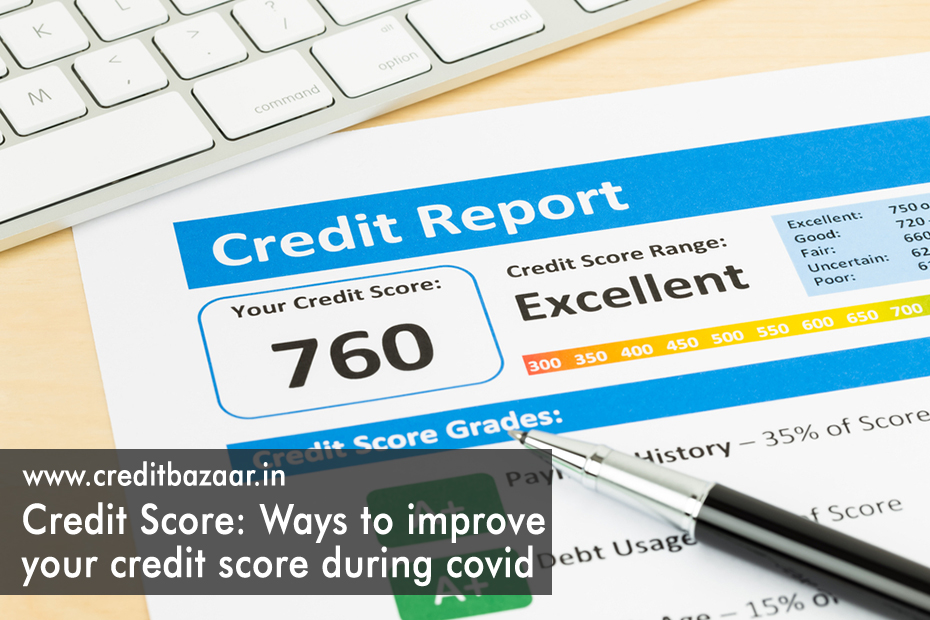

Now coming back to the frequently asked question of how much credit score is a good score? Well, by now I am assuming that you have a fair idea about the standardized range between which a credit score lies. Among that range of 300-900, any credit score that is between 550-700 is considered a decent score, and anything above 700 is considered a good credit score that we all should aspire to achieve. Not to forget that a weak credit report can compel any financial institution to reject your loan request.

To simplify it further let’s have a look at the below-mentioned scores and their interpretations:

- 300-550: Bad credit score and there is a large possibility for your loan application to get rejected.

- 550-700: Decent credit score but here the loan might get approved with a relatively higher interest rate.

- 700-750: Good credit score and your loan will surely get approved with a decent interest rate.

- Anything above 750 is considered an excellent credit score which results in getting a loan approved quickly with a favorable interest rate.

Even though all credit bureaus receive the same type of data, they have a different standard for what they call a good credit score due to the difference in their algorithms. Like if we talk about CIBIL credit score, 750 or more is considered a good credit score whereas, for Experian, a credit score of 780 or more is considered good. Therefore, any individual must have an excellent score. It comes with its sweet perks of low-interest rate on the credit, higher loan amount, speedy approval, quick paperwork, etc. Along with that, multiple lenders are willing to provide you the desired loan amount.

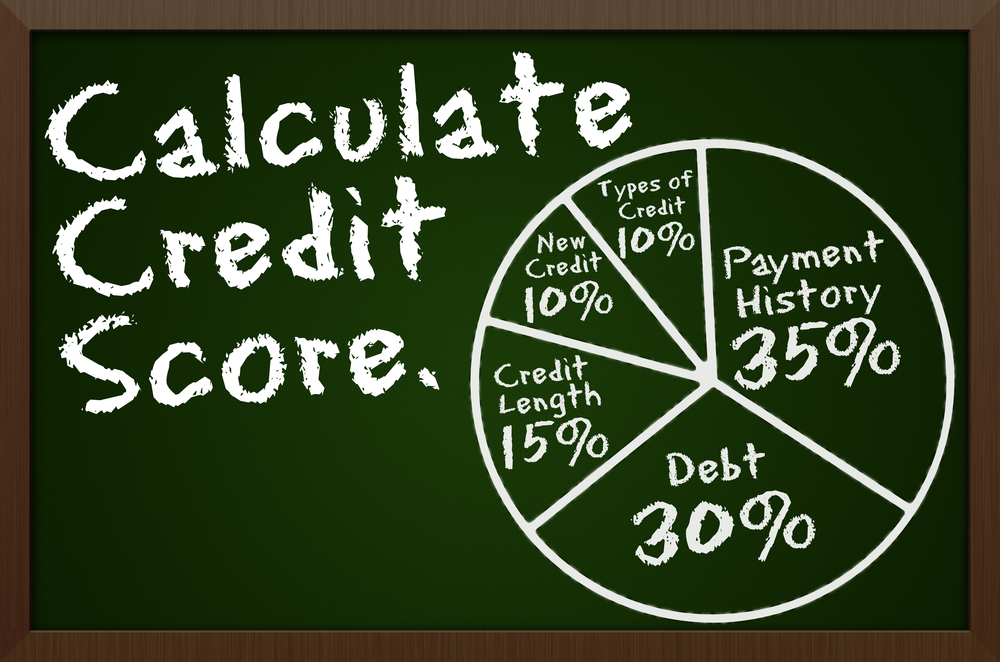

A credit score is derived from your credit history. It includes many factors like in the past if you have ever failed to pay your dues, your credit score will get hampered and go low whereas if you have splendidly paid all your dues on time, it will make you look good to a potential lender. Not to forget, many other factors are included in your credit history that define your credit score.

How is a credit score calculated?

Over time the number of default payments has increased manifolds due to which much more emphasis is being imposed on the credit score of any potential borrower by the financial institutions. But have you ever wondered how this number that decides our fate of getting a particular loan is calculated? Well, to understand that first, we need to know that in India, CRIF High Mark, Experian, CIBIL TransUnion, and Equifax are the 4 most reliable credit bureau companies who have got thumbs up from RBI.

They generate a credit score of an individual based on data received by them from multiple financial institutions like credit card or loan providers across nations. As surprising as it may sound but the tremendous amount of data indeed keeps flooding into the credit bureau from different lenders each day. And with every data received, your credit score profile gets updated. Thus, it is usually advised by financial advisors to at least check your credit score once a year.

Checking a credit score is a painless job, one can do it via any of the above-mentioned credit bureau companies. However, it is observed that the CIBIL score is often talked about in India. Not only that but many financial institutions check your CIBIL score to see if you qualify for a loan. Mainly it is calculated based on a few important factors.

Past relationship with credit repayment

This is quite an imperative factor as it helps in building trust with the lenders. Your repayment history decides whether you will be able to pay the dues on time or not. Late or default in repayment of dues will plunge your CIBIL score drastically.

Types of Credit

The blend of both secured and unsecured loans impact your credit score. A higher percentage of unsecured loans tends to act negatively on your CIBIL score.

Exploring multiple loan options

If you are someone who is actively seeking multiple loans during a short period, you might want to reconsider it as this may adversely affect your credit score.

Credit used

It describes the amount of credit utilized by you compared to the amount of credit availed by you. The rise in the credit utilization ratio might harm your credit score CIBIL as it depicts that your loan burden is increasing and so is the repaying responsibility.

Other Factors

The numbers of loan applications that have been rejected in the past few months also determine the creditworthiness of an individual. Therefore, it immensely impacts your score.

Your credit score might differ a little on different bureaus even though they have received a similar amount of information at the same time from the same lenders. Despite that, there is nothing to worry about the minor difference in credit score as financial institutions understand these differences better and ensure the correct assessment of your loan file.

How does the credit score increase?

Have you recently checked your CIBIL credit score? Has it come below 700-750 and now you are worried about your poor financial health? If yes, then you have landed on the right article. Here are some of the easy ways to strengthen your CIBIL score and to get you back in the bank’s good books.

- The first and foremost thing to do is to check your CIBIL score and know that the results are accurate. There is a slight possibility that even after you have paid all the loan dues on time and have never defaulted, your credit score is reflecting lower than it should be. This could be possible due to some technical glitch. If this is the case with you then you should immediately write down your concern to the credit bureau.

- Repay your loan EMIs and credit card payments on time. Even if there has been some delay in the repayment of any of your installments that doesn’t mean you will self-sabotage by leaving your loan unsettled. As soon as you will start paying the credit card and loan dues on time, a noticeable jump in your credit score can be seen.

- In continuation to the second point, make full payment of your credit card dues rather than just paying the minimum amount required.

- Try to avoid taking multiple loans in a short period. It not only increases your loan burden but also doesn’t look good in the books of credit bureau companies. Frequently applying for loans may signify that the person is going through financial problems and the lenders might not feel comfortable lending money to someone whose loan application has already been disapproved by several other banks.

- To have your credit score improved; you can even take secured loans irrespective of your poor credit report as it won’t matter that much. Then with the right intent and discipline, you can repay your loan dues on time and see a substantial improvement in your credit score.

- Your credit score can also be enhanced by taking a simple step like managing your portfolio mix in such a way that it has less proportion of unsecured loans. Minimum portions of unsecured loans will help in improving the credit score and vice versa.

- Keep an eye on the pending dues of all the joint or co-signed accounts. Don’t forget you are equally liable if there is a delay in payment of those dues.

So, follow these simple steps to get the desired outcome and start working on elevating your credit score from today onwards. With the right mindset and discipline, you will have sound financial health when and if that unforeseen financial emergency pops up.

How to improve credit score during covid?

From a small business owner to salaried personnel, the coronavirus pandemic has wreaked everyone’s financial condition in one way or another. Some of us even had a dreadful experience of getting laid off or getting a salary cut and watching businesses getting shut. As devastating as it may sound, when people are struggling to meet their daily needs, they have another sword on their head to pay their loan or credit card dues on time.

Although RBI gave relaxation to the public, yet post moratorium, not all can pay back their debts which resulted in a dent in their credit scores. Whether you are someone who went through these challenges or not, covid has made everyone looking for ways to improve their financial health to be prepared for those rainy days.

To do so, one should begin with improving their financial report card, and here are some tips to have that shining credit score:

- Keep a track of your credit score

Take baby steps and begin with analyzing your credit report. Find areas that require more attention than the rest and start working on them. And if there is any discrepancy like wrong credentials or something similar, get it fixed.

- No More fresh Loans

Before seeking another loan, it is better to use the existing ones. They already have a credit history and will impact your credit score positively than going for a new loan.

- Minimize credit utilization

No matter how tempting and easy it may look, don’t use 100% of your credit card or overdraft limit. This will only perceive you as an individual with an inability to handle your money smartly. Banks do look at how much free credit limit you have available on your credit cards.

- Trim the list of loans

During the time of cash crunch, we often end up taking another loan. However, the correct way to do it is to use the existing loans only if you are not left with any other option. However, if the case is different and you have any surplus money then you should try to minimize the list of loans. Unsecured loans and loans with the higher interest rate should be paid first and then the rest. This will not only lessen your debt burden but also improve your credit score.

- Regular with repayments

Late payment is better than no payment at all. If you are someone who has struggled to repay their credit card bills or loan dues and has plunged their credit score. Don’t worry, as soon as the outstanding dues will start getting paid, you will see an improvement in your credit score.

How can credit bazaar help you with your credit score during covid?

If life is tough and you cannot keep up with maintaining and checking your credit score, take help from a credit bazaar. Once you sign up, the credit bazaar sends you a monthly credit report and CIBIL scores in your inbox. They also mark the red flags and you can speak to their experts when confusion arises. Not just that, Credit Bazaar is in association with multiple credit lenders across the county and when the time comes and you need a loan, you can easily avail of one from their portal.