Introduction

Home loans are a long-term commitment, lasting more than 20 years. There are two parts of home loans – the principal amount and the interest. Even a small reduction in interest rates can lead to a significant reduction in the total loan over time. Contrary to popular opinion, interest rates on home loans are not determined by the individual. Home loan interest rates are linked to external banks.

Previous lenders used to point out interest rates on mortgages on Marginal Cost-based Lending Rates. In October 2019, the central bank issued a circular asking lender to use new mortgage benches. While the RBI offers a number of options, most lenders have chosen a repo value as a sign of a home loan. The model is known as Repo Rate Linked Lending Rate or RLLR.

The repo rate has had an indirect effect on mortgage interest rates under the MCLR-based lending program, as the extra financial costs include borrowing cost, Under the RLLR type, any change in repo currency has a direct effect on interest rates on home loan. The RBI has reduced its repo value by 115 basis points since February. The reduction came after a cut of 135 points last year. Reducing the three-digit repo rate has led to a reduction in mortgage rates, making homeownership cheaper. Lower interest rates coupled with depressed prices have made the Covid-19 epidemic a great time to buy your dream home.

What is a good credit score?

Exceptional Credit Score: 800 to 900

Consumers with a score of 740 to 850 are considered to be responsible whenever it comes to managing their credit and are the first to receive low interest rates. However, the best scores are between 800 and 850.

People with these points have a long history of zero late payment and low balances on credit cards. Consumers with good credit scores can earn lower interest rates on credit cards, credit cards, loans, and credit lines because they are considered less likely to fail on their contracts. Having a good credit rating especially helps in qualifying for a personal loan, as it often exceeds the performance of a mortgage loan.

Very Good Credit Score: 740 to 799

Debt points between 740 and 799 indicate that the consumer is usually financially responsible for financial and credit management. Most of their payments, including loans, credit cards, utilities, and rental payments, are made on time. Credit card balances are low compared to their credit account limits.

Good Credit Score: 670 to 739

Having a debt of between 670 and 739 puts the borrower closer to or slightly above the US consumer average, as the FICO national average is 711 from October 2020. While they can still get competitive interest rates, they are less likely to charge the right prices for those in the categories. Two high, and it can be difficult for them to get some kind of debt. For example, if a borrower wants an unsecured loan through some financial institution, it is important that they shop around to find the right options for their needs with very few issues.

Fair Credit Score: 580 to 669

Borrowers with credit scores ranging from 580 to 669 are considered to be in the “fair” category. They may have some food in their credit history, but there is no major crime. They may be given credit by lenders, but not at very competitive prices. Although their options are limited, borrowers that require cash can still get strong personal loan options.

Poor Credit Score: Under 580

A person with a score of between 300 and 579 has a very bad credit history. This can be the result of a lot of automation on different credit products from several lenders. However, negative points can also be the result of a collapse, which will stay on the credit record for seven years or more.

What is home Loan

A home loan, also known as a mortgage, is the amount of money a person borrows, usually from banks and lenders. The borrower must repay interest on the Easy Monthly Installments or EMIs for a period that may vary between 10-30 years depending on the type of loan. When you do a home loan, a bank or financial institution accepts the goods you are buying as collateral. This means that it retains the legal right to the property in case it is not paid.

A bank or financial institution charges interest in exchange for its lending services. The interest rate depends on the amount of the principal and the time you will repay the loan. Interest charged on a home loan is tax-deductible, which means you can claim the cost if you file income tax.

What is the credit score to get a home loan

A good CIBIL score for home loan normally starts from 700 upwards. However, the closer you are to 900, the more faith the credit institution will have in your capacity to repay the home loan. With a good credit score for home loan and along with fulfillment of other criteria as decided by the bank, you can get financing up to 85% of the total cost of the property.

CIBIL scores play a major role in processing home loan applications. In fact, it is a major criterion based on which a bank decides whether to process a home loan application or not. When you submit your filled home loan application, the bank will first check your credit score and credit history. If you have Low credit score, and you have a bad credit history, it will most likely reject your application. However, if you have a good CIBIL score, your home loan application will be processed quicker. While there is no universal score, every bank has a minimum CIBIL score, which acts as a cut-off or indicator to accept or reject applications. In general, 750 and above is considered a good score, 350 -750 an average score or maybe unacceptable and below 350 would be considered poor.

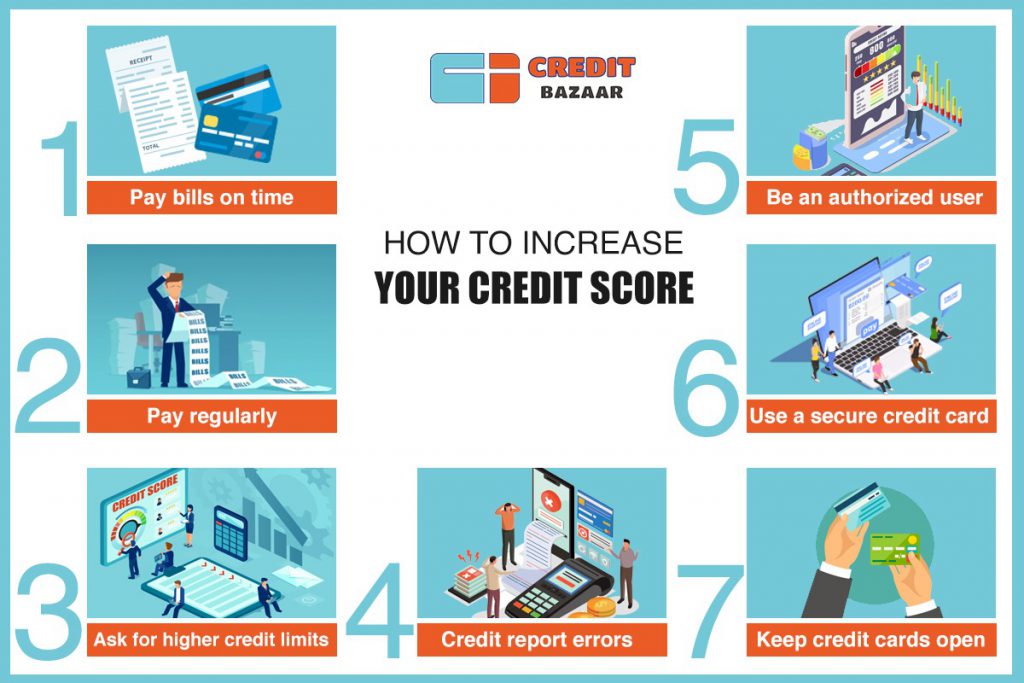

How to increase your credit score

1. Pay bills on time

There is no way to improve your credit if you pay late. Why? Payment history is one major factor affecting credit score, and late payment can remain on your credit report for up to seven years. If you miss a payment for 30 days or more, call the debtor immediately. Arrange to pay if you can, and ask if the lender will consider not reporting the missed payment to the credit bureau.

2. Pay regularly

If you can afford to pay less – often called micro-payments – for a whole month, that can help keep your credit card rates low and improve your credit. Making multiple payments every month triggers a needle in a debt aspect called credit utilization. After payment history, this is one of the things that most influences your score.

3. Ask for higher credit limits

When your credit limit rises and your balance stays the same, immediately reduce your credit usage, which can improve your credit. Call your card provider and ask if you can get a higher limit without asking for “hard” credit, which can temporarily leave your points a few points. If your income goes up, or you add years of good credit experience, you have a better chance of earning a higher limit.

4. Credit report errors

An error in one of your credit report could be to downgrade your score. Fixing it can help you quickly improve your credit. Once you’ve identified them, rectify those errors, so they can be removed. The credit bureau has 30 days to investigate and respond. Some companies promise to disprove mistakes and quickly improve your credit, but continue to be cautious before choosing this option.

5. Be an authorized user

If you have relatives or friends who have a long record of credit card usage and a high credit limit, consider asking if you can be added to those accounts as an authorized user. The account holder does not have to let you use a card – or even your account number – to improve your credit.

6. Use a secure credit card

Another way to build credit from scratch or to improve your credit is to use a secure credit card. This type of card is supported by a deposit; you pay it in advance, and the deposit amount is usually the same as your credit limit. You use it as a standard credit card, and your timely payments help your credit. Choose a secure card that reports your credit work to all three credit bureaus. You could also consider looking at other credit cards that do not require a security deposit.

7. Keep credit cards open

If you are rushing to improve your credit profile, be aware that closing credit cards can make work harder. Closing a credit card means you lose the credit limit of that card when your total credit limit is calculated, which can lead to lower points. Keep the card open and use it periodically, so that the donor does not close it.

How can we help you build your credit score to get a home loan?

Thanks to technology, these days, applying for a home loan online has become easier and faster. There are various online platforms that offer a simple loan application. If you are looking where to get home loan, You may use Credit Bazaar to apply for a home loan online with a few simple steps. Here is a quick guide to home loans online.

If life is difficult, and you can’t keep up with keeping track of your credit score, get help from credit providers. Once you have registered, the credit bazaar will send you a monthly credit report with CIBIL schools in your inbox. They also mark red flags, and you can talk to their experts when confusion arises. This will give you a credit score improvement plan which will also help to improve credit score

In addition, the Credit Bazaar has met with many credit providers throughout the region, and when the time comes, and you need to borrow money, you can easily find one on their website.