What is a credit score?

The credit score is three numbers, usually in the range of 300 to 850, which measures how much is possible to repay the loan and repay the debt.

Credit card companies refer to your credit reports for mathematical formulas that generate your credit scores. A low credit score rating may not limit you to a credit agreement, but you may have to pay higher interest rates or deposit money into a deposit. You may need to pay extra for car insurance or a deposit on the services. Homeowners can use your points to determine if they want you as a tenant.

Higher credit score can give you access to more credit products – and lower interest rates. Borrowers with a score of 750 points or more often have multiple options, including the ability to earn 0% of cash on cars and credit cards with an initial interest rate of 0%.

The most widely used goal-scoring models have a credit range of 300 to 850. Lenders set limits on which parameters they will accept, but here are some common guidelines:

Borrowers who fall into debt are less likely to get a new loan. Additionally, as long as you are able to pay your monthly bills, one of the leading credit repair companies can get bad marks out of your mortgage. If you are trying to get a safe loan through these banks, be sure to compare every thoughtful lender to determine the riskiest options.

What is a good credit score?

Exceptional Credit Score: 800 to 900

Consumers with a score of 800 to 850 are considered to be responsible whenever it comes to managing their credit and are the first to receive credit card low interest rates. However, the best scores are between 800 and 850.

People with these points have a long history of zero late payment and low balances on credit cards. Consumers with good credit score can earn lower interest rates on credit cards, loans, and credit lines because they are considered less likely to fail on their contracts. Having a good credit rating especially helps in qualifying for a personal loan, as it often exceeds the performance of a mortgage loan.

Very Good Credit Score: 740 to 799

Credit score between 740 and 799 indicate that the consumer is usually financially responsible for financial and credit management. Most of their payments, including loans, credit cards, utilities, and rental payments, are made on time. Credit card balances are low compared to their credit account limits.

Good Credit Score: 670 to 739

Having a credit score between 670 and 739 puts the borrower closer to or slightly above the consumer average, as the FICO national average is 711 from October 2020. While they can still get competitive interest rates, they are less likely to charge the right prices for those in the categories. It can be difficult for them to get some kind of debt. For example, if a borrower wants an unsecured loan through some financial institution, it is important that they shop around to find the right options for their needs with very few issues.

Fair Credit Score: 580 to 669

Borrowers with credit score ranging from 580 to 669 are considered to be in the “fair” category. They may have some food in their credit history, but there is no major crime. They may be given credit by lenders, but not at very competitive prices. Although their options are limited, borrowers that require cash can still get strong personal loan options.

Poor Credit Score: Under 580

A person with a score of between 300 and 579 has a very bad credit history.

This can be the result of a lot of automation on different credit products from several lenders. However, negative points can also be the result of a collapse, which will stay on the credit record for seven years or more.

How does bad credit score affect you

1. Extremely risky for regular lenders

Since banks have strict standards for deciding who is eligible for a loan, you may not be eligible for traditional loans or credit cards if you have a bad credit.

Payday loans, for example, are an easy way to get quick cash when you are committed, but they also come with disclosures which means APR can reach 400% to 700%. This should be avoided if possible.

2. You pay more for your loan

Getting a good credit rating will not only help you to have a bank with reputable institutions, but it will also give you better interest rates on loans. Buyers get the best deals on APR with a car loan with 720 points or more, as well as a loan, 750 or more.

The 1.6% difference may sound small, but this time your low credit score will increase your mortgage payment by about a handsome amount over a period of time.

3. Your insurance costs may increase

Dipping your credit score will not automatically increase your payout, and your policy will not be canceled if you drop below 600. But getting bad credit can prevent you from getting a very low rate.

4. You may miss out on job opportunities

Good credit practices give you better job opportunities. In many provinces, employers are allowed to pull out consumer credit reports to make rental decisions.

Your employer will not see your exact credit limit, but with your signed consent they can access your credit report and view details such as your open credit lines, any outstanding balances, car loans, student loans, prepaid, and late repayment rates, or any overdue rates. and collections.

5. You will have a hard time renting an apartment

The 620 credit score is usually the minimum you need to qualify for accommodation.

Some real estate and asset management companies are stronger than others, but you can easily breathe if your credit limit is 700 or more. When you have bad credit, you may need to seek out a cosigner or pay a security deposit before signing a new contract. It is impossible to rent an apartment with bad credit, but it can certainly be very difficult.

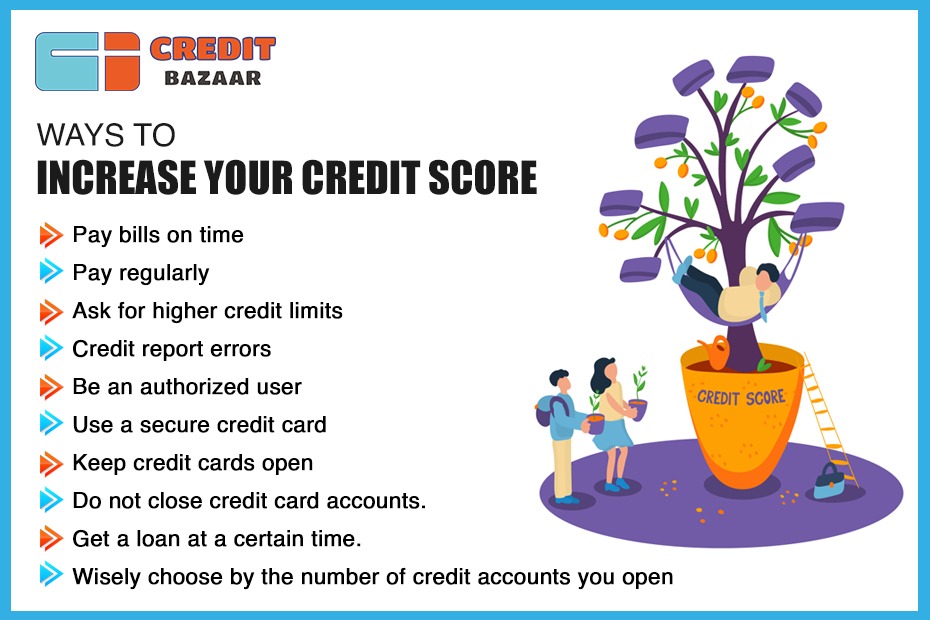

10 Ways to increase your credit score

1. Pay bills on time

There is no way to improve credit score if you pay late. Why? Payment history is one major factor affecting credit scores, and late payment can remain on your credit reports for up to seven years. If you miss a payment for 30 days or more, call the debtor immediately. Arrange to pay if you can, and ask if the lender will consider not reporting the missed payment to the credit bureau.

2. Pay regularly

If you can afford to pay less – often called micropayments – for a whole month, that can help keep your credit card rates low and improve the credit score. Making multiple payments every month triggers a needle in a debt aspect called credit utilization. After payment history, this is one of the things that most influences your score.

3. Ask for higher credit limits

When your credit limit rises and your balance stays the same, immediately reduce your credit usage, which can improve your credit. Call your card provider and ask if you can get a higher limit without asking for “hard” credit, which can temporarily increase your few points. If your income goes up, or you add years of good credit experience, you have a better chance of earning a higher limit.

4. Credit report errors

An error in one of your credit reports could be to downgrade your score. Fixing it can help you quickly improve your credit. Once you’ve identified them, rectify those errors, so they can be removed. The credit bureau has 30 days to investigate and respond. Some companies promise to disprove mistakes and quickly improve your credit, but continue to be cautious before choosing this option.

5. Be an authorized user

If you have relatives or friends who have a long record of credit card usage and a high credit limit, consider asking if you can be added to those accounts as an authorized user. The account holder does not have to let you use a card – or even your account number – to improve your credit.

6. Use a secure credit card

Another way to build credit score from scratch or to improve your credit score is to use a secure credit card. This type of card is supported by a deposit; you pay it in advance, and the deposit amount is usually the same as your credit limit. You use it as a standard credit card, and your timely payments help your credit. Choose a secure card that reports your credit work to all three credit bureaus. You could also consider looking at other credit cards that do not require a security deposit.

7. Keep credit cards open

If you are rushing to improve credit score, be aware that closing credit cards can make work harder. Closing a credit card means you lose the credit limit of that card when your total credit limit is calculated, which can lead to lower points. Keep the card open and use it periodically, so that the donor does not close it.

8. Do not close credit card accounts.

You may think that if you pay or have zero balance in your credit account, it is best to close the account completely, but that could hurt your score. Even if you close the account, it will still appear in your credit report, and it will lower your limit rates, lower your credit score.

9. Get a loan at a certain time.

Debt schools differentiate between seeking a single loan and searching for multiple new credit lines, based on the length of time, the recent credit applications arise.

10. Wisely choose by the number of credit accounts you open.

Be wise about opening accounts, otherwise you can end up being overly manageable, and your points will do just that.

How can we help you improve your credit score

You will be able to survive in a bad credit situation, however, it will not always be cheaper and easier than ever if your credit score is bad. Credit points are a very important and important factor in seeking many benefits over time. High credit score can make your financial life a lot easier and can help you save a lot of money. Credit Bazaar highlights the importance of the above debt in detail and provides you with various services related to insurance premiums, credit cards, personal loans, Corporate Health programs, Mutual Funds, credit score Improvement Plans, and so on.