Introduction

A credit score is a three-digit number having a range between 300 to 900. Bankers and other lenders consider it before approving any credit card or loan to an aspiring applicant. Even employers, in some cases, use it to decide your eligibility before appointing you to work with them.

Credit Score, also known as ‘Credit Rating’ is a number based on the level analysis of the track record of credit files and history of repayment.

Credit Score is a yardstick against which the creditworthiness of the aspiring borrower is measured. It indicates a person’s ability to pay off debts in time, which in turn, determines the terms and conditions on which the loan shall be sanctioned.

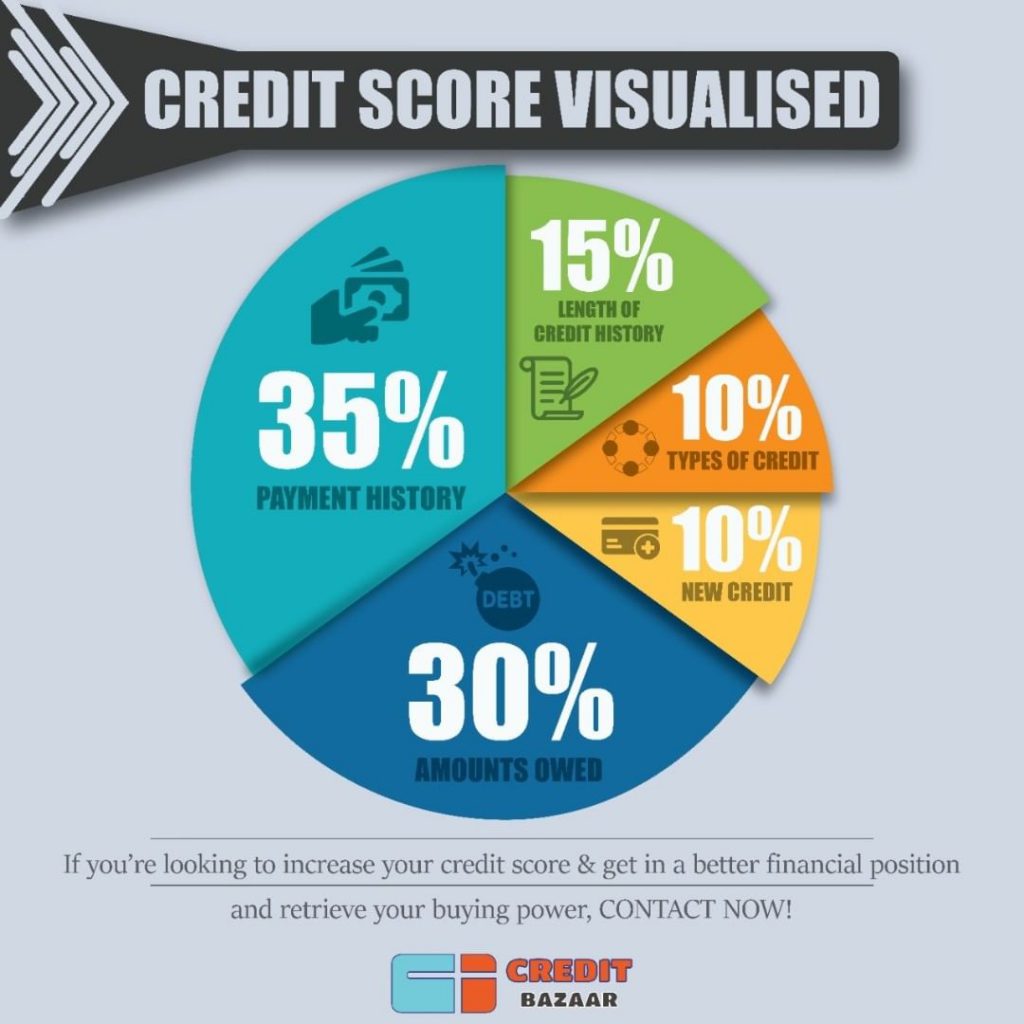

The components and the information in the credit report form the basis to calculate the credit score. It is impossible to calculate a credit score without a credit report. Five main factors determine your credit score and not all of them have equal weightage. These are:

- Payment History (35%)

- credit utilization (30%)

- Credit History (15%)

- Credit Mix (10%)

- New Credit (10%)

Credit scores can be calculated in different ways. The positive credit score always looks good to the lender and opens the door of opportunities for an applicant. The credit score indicates what’s in store for the borrower. Here’s how:

• A credit score of 800 and above indicates fast approval of loans and a lower rate of interest on loans applied for. It is considered excellent. This score indicates responsible financial management.

• A credit score ranging from 740-799 looks good as well. With this, an aspiring borrower may get a loan offer with a low rate of interest.

• A credit score ranging from 670-739 provides limited options. Borrowers are offered competitive interest rates.

• A credit score ranging from 580-669 is considered fair. But the lenders don’t happily provide debts at competitive prices.

• With a credit score under 580, immediate action to fix this must be initiated. This is a sign that warns the aspiring borrower of remedial actions that must be implemented without any further delay.

Having a good credit score signifies that an aspiring borrower is a responsible person who has consistently followed financial obligations. The probability of lenders lending money to such aspirants is far great than those who have poor credit scores.

Periodic reviews of a credit report are highly important as it makes you aware of your credit score from time to time. In case, any misinformation gets detected on the credit report, the same should be solved with proper communication with the agency. Keeping the track of credit scores is quintessential. This always gives you an upper hand when it comes to controlling your finances.

Importance of Having a Good Credit Score

When the borrower applies for the credit, the credit score is the first concern of the lender. Credit Reports and Credit Score are two important components that indicate a borrower’s ability to repay debts on time. Credit Score helps a great deal in risk assessment. The lender expects a borrower to fit in his standards. Even though there are other means to establish the trustworthiness of the borrower, the credit score is, indeed one of the most important determinants and must be maintained with diligence, so it doesn’t fall on the lower side.

Here are a few reasons why the credit score is considered very important:

- A key determinant for eligibility of loans:

Credit score indeed is a key determinant when it comes to granting loans. The higher the credit score, the more eligible you are for loans and vice versa. While a good credit score indicates timely repayment of debts, a low credit score indicates a lack of diligence and management to pay debts on time. A low credit score doesn’t make the borrower trustworthy as it shows a lack of expertise on his part when it comes to handling credit, as it increases the possibility of defaults in payments.

- Low Rate of Interest:

One of the advantages of having an excellent credit score is that the borrower may avail of loans at a lower rate of interest. The lender takes into consideration repayment history, excellence in handling credit, and ability to pay timely in the future before granting any loan. Once the lender is satisfied with the record so far, the borrower has a high chance of availing of loans at a low rate of interest. The excellent credit score, the higher the possibility by the lender to offer low rates of interest

- Credit Card Limits:

Apart from the lower rate of interest and loans, a high credit score proves to be a tremendous help in getting a higher loan amount. A bad credit score results in a lower card limit too. Having an excellent credit score indicates your ability to handle credit consciously and makes it easy for lenders to offer you a credit card that has a high credit limit.

- Faster Loan Approvals:

Faster loan approvals are one of the most significant benefits of having a high credit score. Many times lenders prefer to offer pre-approved loans to those applicants who have a high credit score and long credit history. Having a good track record is very important as the loan application gets approved immediately and doesn’t have a waiting period.

- Very useful at the time of Visa Application:

Having a high credit score is highly recommended and adds value to the entire process of visa application. This is one of the prominent advantages of having a high credit score. Countries like the United States of America or the United Kingdom insist on your income tax records when you apply for a visa. Many factors influence visa application. However, having a good track record of credit score is one of the indicators of credibility of the applicant and helps the entire process gain momentum.

- Credit card:

Not only loans, but a high credit score is very useful when it comes to the credit card that gives benefits and better rewards. When the credit score is 750 or more than that, many options are available to the applicant to make a well-thought decision.

- Benefits in the future:

Even though there is no imminent need to apply for a loan currently, maintaining a good credit score comes in handy when you wish to apply for home loans, credit cards, other personal loans, or any other kind of loan in the future. One must always maintain a good credit score and an excellent credit record as it gives a clear idea to the lender about your ability to handle credit.

- Gives the upper hand to the borrower:

When it comes to obtaining a new loan or a credit card, you are always an advantage if you have a good credit score. The secret is, having a good credit score gives you the negotiating power. You can always find other attractive offers from other companies because of your excellent credit score. On the contrary, having a low credit score immediately deprives the borrower of other credit options or opinions. Also, lenders aren’t excited about the loan proposal too. This delays the procedure for the loan.

Ways to Improve Credit Score

If you require financial assistance to purchase any home, car, or for any other purpose and are willing to apply for a loan in connection with the same, you must have a good credit score. Here are a few things you must consider in the context of improving your credit score.

- Periodic Review of Credit Reports:

Periodic review and checking of credit history are highly essential as it enables you to see what is working in your favor and what is not.

Once you find out what is helping your credit score, it becomes very easy to maintain that. Record of timely payments, low balances on your credit cards, a mix of different credit card and loan accounts, older credit accounts, and minimal requirement of new credit are the prime contributors to a higher credit score.

Once you detect factors that are adversely impacting your credit score, preventive measures for the same can be immediately implemented. Delay in payments or default in payments, high credit balance brings a negative influence on credit score and must be kept under check.

- Bill Payments:

Want to improve your credit score? Simple! Make sure there are no late payments at any cost. Automating bill payments directly from your bank account is one of the ways to ensure timely payments. A proper filing system makes it easy to keep track of monthly bills, which in turn helps to set alerts for the due dates.

Another alternative is charging as many monthly bills as possible to a credit card. With this, you will be able to pay the balance in full every month to avoid interest charges. This strategy makes a positive impact on your credit score.

- Consolidation of Debts:

If any debts are outstanding, you could apply for a ‘Debt Consolidation Loan’ and pay them off. Now you have only one payment to deal with, rather than many. This can also improve your credit utilization relation and credit score, in turn.

- Lesser credit Utilization:

Credit utilization means the portion of the credit limit that you are using at any given time. After the payment history, credit utilization is the factor important for the lender.

Making monthly payment of credit card balances in full is the best and the easiest way to keep your credit utilization in check. If you can’t do that always, ideally keep your total outstanding balance at 10% or less. If that too, is difficult, let the total outstanding balance be 30% or less of the total credit limit.

The lesser is the outstanding balance the better is the credit score and vice versa.

- No New Application for Credit Cards:

Credit card companies check thoroughly before sending you preapproved credit offers. A typical ‘Soft’ inquiry may include checking your credit, thorough analysis of checking already conducted by financial institutions with whom you deal on regular basis, your files and documents in connection with the credit score. These inquiries don’t affect your credit score adversely but hard inquiries have a chance to make a negative impact on your credit score. Hard inquiries include an application for a new credit card, a mortgage, or some other form of new credit. The best way to increase the credit score is to avoid applying for new credit for a while.

- Tracking your progress:

Credit monitoring also helps you track progress. Credit monitoring services protect you from identity thefts or fraud. For instance, if you get an alert about opening up a new credit card but you haven’t opened any such account, you can immediately contact the credit card company to report suspected fraud.

Credit Score Improvement Plans by Credit Bazaar

Credit Bazaar is a financial technology start-up. We are based in Mumbai, Gujarat, and Kolkata. It has come up with various customer-friendly bazaar improvement plans. You may choose the option that is convenient for you and suits your needs. Our bazaar improvement plans include the following plans:

- Standard plan

- Gold plan

- Platinum plan

- Elite plan

- Imperia plan

- Insignia plan

Different plans are priced differently and offer various facilities for the improvement of credit score.

How Can We Help You Improve Your Credit Score

It is better to avail of professional services in connection with the improvement of the credit score. The experience and expertise of professionals at Credit Bazaar always help to improve credit score, which may otherwise take several weeks or even months to make a visible impact on your score.

Having professional assistance gives a result-oriented, tactful and strategic approach and you can see the improvement of credit score very soon. It is a game-changer move.

With our dedicated team and in-depth understanding of market pulse, we have helped many of our clients along the way to make their dreams come true.

If you need guidance for maintaining good credit score or improving the credit score, the Credit Bazaar is your go-to guide.